Trump’s Customs Duties Impact European Markets

In a significant development for global trade, the customs duties imposed by the Trump administration have officially come into effect, exerting considerable pressure on European equities.

Overview of New Tariffs

The decision to implement these tariffs underscores a continued focus on protectionist trade policies, which have become increasingly prevalent in the international landscape. The tariffs are notably designed to protect domestic industries from foreign competition, particularly in sectors deemed critical to national interests.

Market Reactions and Implications

European markets responded sharply to these new tariffs, with fluctuations observed in key indices. Investors are closely monitoring the broader economic implications, anticipating that these duties could trigger retaliatory measures from affected countries. The heightened uncertainty is creating a cautious climate among stakeholders, influencing trading strategies and investment decisions across the continent.

Key Details

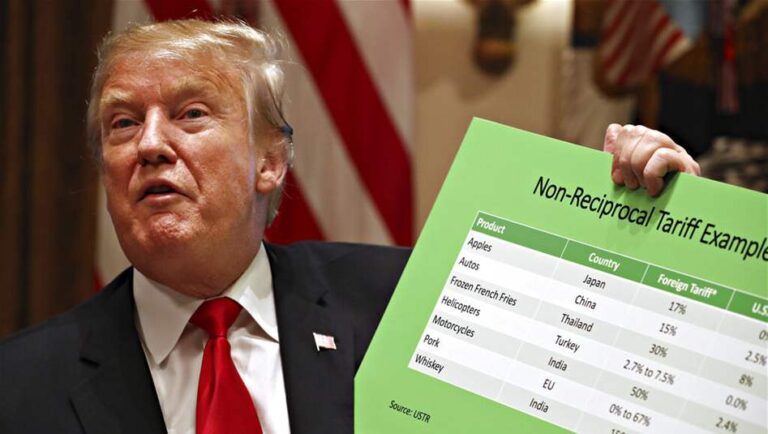

The specifics of the customs duties are as follows:

| Type of Product | Tariff Rate (%) | Effective Date |

|---|---|---|

| Steel | 25 | [Insert Date] |

| Aluminum | 10 | [Insert Date] |

This strategic maneuver aligns with the Trump administration’s broader objectives of altering trade dynamics that are perceived as unfavorable to U.S. industries. The long-term consequences of these policies remain under scrutiny, particularly as global economic interdependence continues to evolve.

Conclusion

As European markets grapple with the introduction of these tariffs, the potential for an escalated trade conflict looms large. Economic analysts and market participants alike will be keen to assess how these developments reshape trade relations and alter the competitive landscape for businesses both in Europe and the United States. The future trajectory of trade and economic policy will be pivotal in determining the potential repercussions of these customs duties, influencing global economic stability.